We NEVER charge a "percentage of assets"

You get simple year-end tax reports from the broker that services your OmniFunds account.

You are 100% in control of your account. You see every trade placed by your OmniFund... FULL TRANSPARENCY

LEGAL NOTICE: Unlike offshore-broker hosted trading bots that could vanish with your money overnight, OmniFunds works exclusively with established U.S. brokers.

Hi, I'm Ed Downs.

For the past 35 years, I've been developing automated trading systems that have helped thousands of investors beat the market.

Amazon Best Selling Author of "7 Chart Patterns That Consistently Make Money"

But nothing I've created comes close to the power and safety of what I'm about to share with you.

Here's a preview of what you're about to uncover in the letter below...

Real Results, Real People, Real Wealth

Featured in reputable financial publications

We have customers who have been with us since 1994

Testimonials from long-term users available on our website

Operates in Full Compliance with U.S. Laws and Regulations

Trades only through US-regulated brokers

Timely audits ensure ongoing compliance

Fully-compliant with IRS regulations for Roth IRAs

Your Quick Setup System to Financial Freedom

Blazing fast setup process, no technical skills required

100% web-based platform - no software to install

Dedicated U.S. based customer support team

Your Safety Net in the World of High Finance

You own the account and have 100% control. We can't view any sensitive information. Complete Data Privacy.

Funds can be withdrawn at any time without penalties

No lock-up periods or restrictions on your capital

Your Golden Ticket to Tax-Free Growth

Tax-free gains when trading out of Roth IRA (optional to use with IRA)

Complies with all IRS rules for tax-advantaged accounts

Annual tax reporting through broker provided for easy filing

Tailor-Made Success: Customizing Your Wealth Journey

Multiple risk profiles available to suit your comfort level

Adjustable trading frequency and position sizes

Option to exclude specific stocks

Consistently Beating The Market

Outperformed traditional RoboAdvisors by 400% in our extensive backtesting results

No percentage of assets share. You only pay a nominal monthly license fee to continue running the algorithm and keep the rest

Historical data shows we outperformed the S&P 500 over the past decade

Nirvana Systems has won over 100 TASC

Readers Choice Awards since 1999.

Standalone Analytical Software

Futures Trading Systems

End of Day Data

Stock Trading Systems

Artificial Intelligence Software

Want to Test-Drive a Trading Algorithm That's Custom-Tailored To Your Retirement Goals?

Start Your Personalized Setup By Filling Out The Questions Below

This invention was tailor-made just for you...

Because we know you're tired of:

Measly "below average" returns from "safe" investments...

Hard-earned savings get eaten away by inflation...

Worried about having enough money to retire comfortably (or stay retired)

Now after decades of developing automated trading systems...

I've finally cracked the code on how to generate consistent, double-digit monthly returns in with built-in downside protection that could save your nest egg even if the unthinkable happened.

I call it OmniFunds. And it's one of the world's foremost fully automated trading platforms focused on U.S. federally regulated equities designed specifically to trade equities through US-regulated brokers.

...all while delivering tax-free returns (when trading out of your Roth IRA) that have outperformed traditional Robo-Advisors by up to 400% in our backtesting results.

Best of all, it takes literally no time to set up and requires zero technical skills.

There's no complicated software to install, no VPS required – it's 100% web-based and designed for the average investor.

Unlike offshore trading algorithms that could vanish with your money overnight, this software works exclusively with established US brokers. That means your funds are protected.

But what truly sets OmniFunds apart is its unique "Selective Switching" approach.

...but instead of betting on a single horse, you have the ability to switch your bet to the leading horse at any moment during the race.

That's EXACTLY what our Advanced Switching Algorithms does in the stock market.

These algorithms are constantly analyzing millions of data points in real-time, looking at factors like:

Relative strength between stocks

Market sentiment analysis

Earnings momentum

Sector rotation trends

And dozens of other proprietary indicators

This enables our Premium OmniFund "SafeHarbor" to consistently put your money on the potential winners.

In the next few minutes, I'm going to show you exactly how it all works, why it's so effective, and how you can start using it as soon as today.

But first, let me answer your obvious question…

"Is This Too Good to Be True?"

I know what you're thinking...

But hold onto your skepticism for just a moment, because what I'm about to reveal could change your financial future forever.

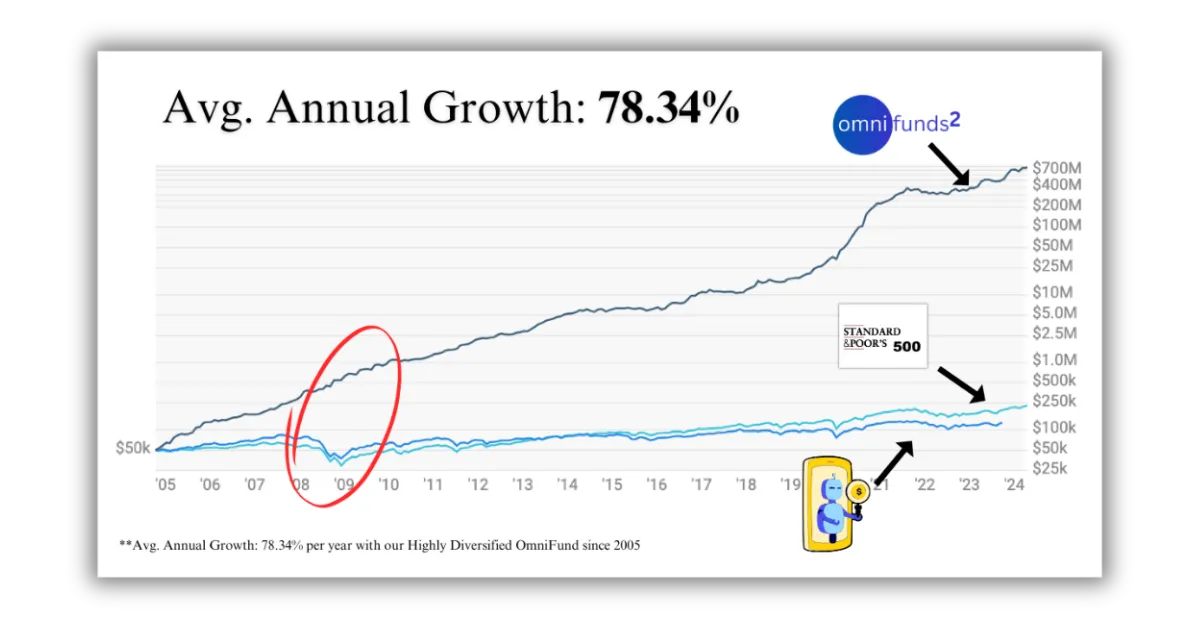

While Wall Street was busy playing roulette with your 401(k), we've been refining a financial juggernaut that's weathered every market storm since 2005.

Through crashes, bubbles, and everything in between, our backtested portfolios have shown consistent, jaw-dropping performance year after year in simulated trading.

And it's not beginner's luck – it's 35 years of experience that's left the market STUNNED such a system even exists.

Now let me take you back to 2008 - a year that still sends shivers down the spines of many investors.

While the S&P 500 plummeted 38.5%...

The backtesting results showed our algorithm didn't just survive - it thrived, and could have captured a 28% gain.

It showed the potential to thrive and leave the market behind during one of the toughest financial crises in history.

But that was just the beginning.

Fast forward to today, and OmniFunds is rewriting the rules of what's possible in automated trading.

Seriously, the numbers speak for themselves 👇

Historical Performance: Our Highly Diversified OmniFund has achieved a 68% annual return with just 13% drawdown over 19 years in backtested simulations. That's not a typo - it's 68% per year, consistently, for nearly two decades.

PAST PERFORMANCE OR BACKTESTING RESULTS IS NOT A GUARANTEE OR A RELIABLE INDICATOR OF FUTURE RESULTS. We are not financial advisors, asset managers or investment advisors. Omnifund provides tools to traders. The exceptional growth numbers achieved by some of our users depend on various factors, and we do not guarantee any specific amount of growth or success through any of our algorithms.

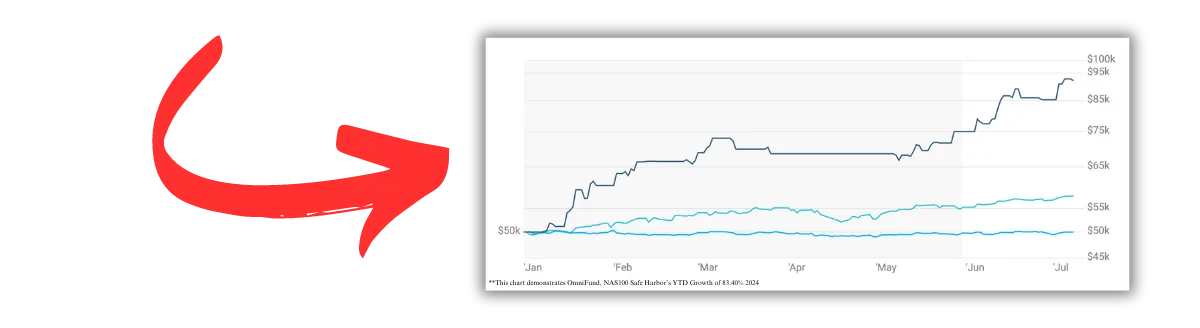

Live Trading Results: Since we launched OmniFunds 2 Premier, it's been delivering impressive results. We see 83.40%, the YTD return for NAS100 Safe Harbor and over 20% return in JUST ONE MONTH since its release at the end of May...(kind of makes traditional investments look like pocket change!)

Comparative Analysis: While Robo-Advisors have been scraping by with a measly 6% average return over the past 5 years, and the S&P 500 has been patting itself on the back for 14%, our portfolios have been showing performance that would make your average "guru" blush.

But it's not just about astronomical returns...

Early adopters get all these benefits to go along with it...

Unparalleled risk management (that lets you sleep like a baby, even during market turmoil)

The ability to trade automatically with elite algorithms out of your Roth IRA (👋 Hello, tax advantages!)

A system that works 24/7 (so you can finally take that vacation without worrying about your trades)

Not to mention...

Unprecedented Portfolio Aggregation

Unlike any other system, OmniFunds can blend up to 10 different portfolios in a single OmniFund. This level of diversification was simply not possible before, allowing for dramatically smoother returns over time.

Industry's Most Advanced Risk Controls

When you sign up you're getting three powerful risk management to preserve your wealth with features that are unmatched in the industry: Earnings Report Shield, Exposure Cap, and Market State Monitor.

Algorithmic Switching

Our new algorithms don't just look at individual stocks or simple indicators. They perform complex comparative analyses between stocks and assess overall market strength to consistently identify the strongest performers.

Unmatched Flexibility

You can now create your own custom OmniFunds or leverage the expertise of our top traders through the new OmniFunds Associates feature. Unique customization and expert-driven strategies

Proven Performance

While other systems struggle to beat market averages, you'll be dwarfing both traditional investments and robo-advisors, for example, has achieved a 68% annual return with just 13% drawdown over 19 years -

But between you and me...You've been in this game for a while now, right?

You've seen investment systems come and go.

Maybe you've even been burned by promises of "guaranteed returns" or "foolproof algorithms" in the past.

And let's be honest, if you're like any of our 5,000+ customers, you're probably thinking one of three things right now:

"This sounds too good to be true. What's the catch?"

"I'm already doing okay with my current setup. Why change?"

"I've tried these before, and they couldn't adapt to real market conditions."

Valid concerns. All of them. In fact, they're the exact issues we set out to solve...

What we ended up with is a complete reimagining of what's possible in automated trading.

Remember how I mentioned our new Advanced Switching Algorithms? This isn't just some fancy term we cooked up in marketing.

It's a fundamental shift in how we approach the market. Instead of relying on fixed indicators or simplistic trend-following,

We're constantly analyzing millions of data points in real-time. It's comparing stocks against each other, assessing overall market strength, and making decisions based on the most up-to-date information available.

Think of it like having a team of expert traders working for you 24/7, always keeping your money in the best possible position.

Only it's faster, more accurate, and never needs a coffee break.

We've even built in multiple layers of risk management that go beyond anything we've ever offered before.

This is crucial for those of you who've been hesitant about fully automated systems in the past:

The Earnings Report Shield, Exposure Cap, and Market State Monitor work together to protect your investments in ways that even the most vigilant human trader couldn't match.

So if you're holding back because you're worried about sudden market shifts or unexpected events, know that OmniFunds is designed to handle these situations more effectively than any system on the market today.

And for those of you thinking, "I'm doing okay with my current setup" – I hear you.

But ask yourself this: are you truly maximizing your potential returns while minimizing your risk?

Are you able to take advantage of every market opportunity without being glued to your screen?

If not, then you owe it to yourself to at least give OmniFunds a closer look.

Because at the end of the day, this system isn't about replacing your investing knowledge or experience – it's about enhancing it, automating the tedious parts, and potentially taking your results to levels you might not have thought possible.

Remember, if you were a long-time customer of ours, you would know that we've continuously innovated and improved our offerings over the years.

OmniFunds is the next step in that evolution – and it's a big one.

So don't let past experiences or current complacency hold you back from joining us in the new era of automated trading. Click the button below and submit your application to see if you qualify.

The market waits for no one, and neither should you.

Let's talk about the elephant in the room – the real culprit behind why so many investors, even experienced ones like yourselves, struggle to consistently beat the market.

It's not lack of effort. It's not lack of knowledge. And it's certainly not lack of dedication.

The real enemy? It's the outdated, inflexible options available to everyday investors that dominate the market today.

You know the ones I'm talking about:

Traditional trading platforms that require you to be glued to your screen 24/7.

"Black box" algorithms that work great... until they don't, leaving you high and dry when market conditions change.

These systems are holding you back, and here's why:

Robo-Advisors, with their average 6% returns, are essentially leaving money on the table. They're designed for the masses, not for savvy investors like you who understand the potential of the market.

Traditional trading platforms? They're stuck in the past, relying on outdated indicators and requiring constant manual intervention. In today's lightning-fast markets, that's like bringing a knife to a gunfight.

And those "black box" algorithms? They're a ticking time bomb. Sure, they might perform well for a while, but when the market shifts – and it always does – they can't adapt.

The result? Devastating losses that can wipe out months or even years of gains.

The financial industry wants you to believe this is just "how it is."

They want you to accept mediocre returns, high stress, and sleepless nights as the cost of playing the game.

Why? Because it's profitable... for them.

It's a rigged system, designed to keep retail investors like you from truly harnessing the full potential of the market.

But you know what?

You deserve better. You've put in the time, you've honed your skills, and you understand the markets. You shouldn't have to settle for systems that can't keep up with your expertise (or ambition).

That's exactly why we created OmniFunds.

We've taken everything that's wrong with current trading systems and turned it on its head:

Instead of rigid rules, we've built in adaptive algorithms that evolve with the market.

Instead of requiring constant monitoring, OmniFunds works tirelessly so you don't have to.

Instead of accepting mediocre returns, we've designed a system that aims for market-beating performance year after year.

OmniFunds isn't just another trading system. It's a revolution against the status quo.

It's a declaration that you, as an investor, deserve tools that match your expertise and amplify your potential.

So the next time you feel frustrated with the limitations of your current trading setup, remember: it's not your fault. The system was rigged against you from the start.

But now, with OmniFunds, you have the power to change the game.

To level the playing field.

To finally have an investing system that works as hard as you do – and potentially delivers the results you've always known were possible.

Ready to stop playing by their rules and start making your own?

OmniFunds gives you access to the world's most powerful trading technology that you can apply to your U.S.-Based broker account.

The unique advantage you're getting is that it automatically adjusts your investments in a continual effort to achieve maximum returns with minimal risk.

You stay connected to what's happening in your account on a daily basis. And, it's also more affordable than most other options.

You are 100% in control of your account. You see every trade placed by your OmniFund...FULL TRANSPARENCY.

We NEVER charge a "percentage of assets" fees (only a nominal monthly licensing fees so you never lose access to our algorithm)

You get simple year-end tax reports from the broker that services your OmniFunds account.

But here's where it gets really interesting.

Unlike traditional systems that might just look at a stock in isolation, our algorithms are comparing stocks against each other and against overall market conditions.

They're not just asking, "Is this stock going up?"

They're asking, "Is this stock outperforming its peers and the broader market?"

This allows OmniFunds to identify not just good opportunities, but the best opportunities available at any given moment.

Now let's take it a step further...

OmniFunds doesn't just run one set of these advanced algorithms. It can run up to 10 different portfolios simultaneously, each with its own unique strategy.

Think of it like having a team of expert traders, each with their own specialty, all working together to maximize your returns.

Our system then aggregates these portfolios, balancing them dynamically to produce smoother, more consistent returns over time. It's like diversification on steroids.

And what about risk management?

This is where OmniFunds really shines. We've built in multiple layers of risk management that adapt to market conditions in real-time:

Earnings Report Shield: The system automatically exits positions before earnings reports and re-enters after the dust settles. Remember that 25% overnight drop I mentioned earlier? This feature is designed to help you avoid those nasty surprises.

Exposure Cap: This limits your exposure to any single stock, even across multiple portfolios. It's a safeguard against over-allocation that could leave you vulnerable to single-stock risk.

Market State Monitor: This is like a weather vane for the market. It constantly assesses overall market conditions and adjusts trading accordingly. In bullish conditions, it might be more aggressive. In bearish conditions, it could dial back risk or even move to cash.

Let me give you a real-world

example of how this might play out...

Let's say the market is generally bullish, but there's increasing volatility in the tech sector due to regulatory concerns. Here's how OmniFunds might respond:

The Advanced Switching Algorithms might start favoring stocks in other sectors that are showing relative strength.

The Multi-Portfolio Aggregation could shift more weight to portfolios that are performing well in the current market conditions, perhaps favoring value stocks over growth.

The Adaptive Risk Management might increase the Exposure Cap for well-performing sectors while decreasing it for tech stocks.

Within the switching interval, which can be a few days to a week, the system will exit stocks that are falling due to unforeseen events.

All of this happens automatically, without emotion or hesitation.

The result?

A trading system that's always positioning your investments for optimal performance based on current market conditions.

Now, I know what some of you might be thinking:

"Ed, this sounds great in theory, but how do I know it will work in practice?"

That's a fair question.

And it's why we've been rigorously testing and refining OmniFunds for months before bringing it to you.

Our back-tests show consistent outperformance across various market conditions, including bull markets, bear markets, and everything in between.

But more importantly, we're already seeing impressive results in live trading.

Remember those performance figures I mentioned earlier? That's not hypothetical – that's real money, real trades, real results. Of course, past performance doesn't guarantee future results...

But here's what IS guaranteed:

We're so confident you'll love this software that if your OmniFund doesn't outperform Robo-Advisors in the 365-days following your purchase, then we'll refund your money.

You see - with OmniFunds, you're getting a system that's designed to adapt and evolve with the market. It's not just reacting to what's happening now – it's positioning you for what's coming next.

That's the power of OmniFunds. It's not just a trading system – it's your own personal wealth robot, working tirelessly to maximize returns and minimize risk.

So are you beginning to see why I'm so excited about this? Can you imagine the potential impact this could have on your trading results?

Ready to supercharge your portfolio?

OmniFunds is your ticket to algorithmic trading success. Choose the level that matches your ambition and watch your returns soar!

Here's what you get when you join OmniFunds today:

Full Access to OmniFunds Advanced Switching Algorithms. You'll have immediate access to our cutting-edge trading system, including all future updates and improvements.

Multi-Portfolio Aggregation Capability. Select OmniFunds that use multiple portfolios simultaneously for unparalleled diversification.

Adaptive Risk Management Suite. Including the Earnings Report Shield, Exposure Cap, and Market State Monitor.

Real-time Portfolio Tracking and Performance Reports. Monitor your investments 24/7 with our user-friendly dashboard.

Weekly Strategy Updates and Market Insights. Stay informed with our expert analysis of market trends and opportunities.

Priority U.S.-Based Customer Support. Get help when you need it from our experienced support team. WE ANSWER THE PHONE!

Full Access to OmniFunds' Advanced Switching Algorithms. You'll have immediate access to our cutting-edge trading system, including all future updates and improvements.

Multi-Portfolio Aggregation Capability. Create and manage up to 10 different portfolios simultaneously for unparalleled diversification.

Adaptive Risk Management Suite. Including the Earnings Report Shield, Exposure Cap, and Market State Monitor.

Real-time Portfolio Tracking and Performance Reports. Monitor your investments 24/7 with our user-friendly dashboard.

Weekly Strategy Updates and Market Insights. Stay informed with our expert analysis of market trends and opportunities.

Priority U.S.-Based Customer Support. Get help when you need it from our experienced support team.

Typically, this level of professional money management would cost you tens of thousands of dollars a year.

Many hedge funds charge 2% of assets under management plus 20% of profits.

On a $500,000 portfolio, that could easily run you $20,000 or more annually.

But with this special offer, you won't pay anywhere near that.

Ready to supercharge your portfolio? OmniFunds is your ticket to algorithmic trading success. Submit your application to see if you qualify to license the world's most powerful automated trading platform.

Typically, this level of professional money management would cost you tens of thousands of dollars a year.

Many hedge funds charge 2% of assets under management plus 20% of profits.

On a $500,000 portfolio, that could easily run you $20,000 or more annually.

But with this special offer for our loyal customers, you won't pay anywhere near that.

In fact, you won't even pay the $9,995 that we'll be charging once this promotion ends...

Ready to supercharge your portfolio?

OmniFunds is your ticket to algorithmic trading success. Choose the level that matches your ambition and watch your returns soar.

Don't let another day of potential profits slip away.

**IFM is not a registered investment advisor., and charge a percent of assets under management. However, we do charge for server usage in sending orders to the broker, which costs $49 per month and up, depending on activity.

C'mon, let's look at the bigger picture here...

By now you've heard all about...

Advanced Switching Algorithms that based on simulated trading could deliver returns of 68% annually with just 13% drawdown over 19 years.

Multi-Portfolio Aggregation for unprecedented diversification and risk management.

Adaptive Risk Controls that protect your investments 24/7

You've heard how it's outperforming robo-advisors by up to 400% and leaving traditional investment methods in the dust.

You've learned about the ironclad 365-day money-back guarantee that removes all risk from your decision.

So, let me ask you this:

What do you really have to lose?

The way I see it, you have three options:

If you're already consistently outperforming the market...

If you're not worried about missed opportunities or sleepless nights wondering if you've made the right trades...

Then maybe OmniFunds isn't for you.

You can spend hours each day analyzing market trends, managing multiple portfolios, and trying to stay ahead of earnings reports and market shifts.

But if you have the time, expertise, and emotional discipline to do all this consistently, more power to you.

Put our proven algorithms to work, leverage the power of AI and machine learning, and potentially see the kind of returns that could significantly impact your financial future.

Of these three options, ask yourself:

What's going to be easier for you?

What's going to give you the best chance at achieving your financial goals?

Now, let's talk about what you might lose if you don't take action today:

1. Time: Every day you're not using OmniFunds is a day of potential gains lost. Remember, compound interest is called the eighth wonder of the world for a reason.

2. Opportunity: The markets wait for no one. While you're deciding, others are already putting OmniFunds to work for them.

3. Peace of Mind: How much is it worth to you to know your investments are being managed by cutting-edge algorithms 24/7, adapting to market conditions in real-time?

This is could be your only chance to lock in your special offer.

But perhaps the biggest potential risk is this:

The regret of looking back months or years from now...

...seeing the performance of OmniFunds, and wondering..."WHAT IF?!"

So hurry up and apply now!

Because the clock is ticking...and pretty soon you'll miss out on introductory pricing...

Plus, don't forget about our 365-day money back guarantee!

If we don't beat the Robo-Advisors returns in a one year period then we'll HAPPILY refund your purchase 🙂

I'll see you on the inside.

Sincerely,

Ed Downs, Manager

Nirvana Systems, LLC

Intelligent Fund Management, LLC

P.S. - Still can't decide whether or not to apply for access to OmniFunds? Then be sure to see what our long-time customers say about us and the financial products we've created over the last few decades 👇

© 2024 All Rights Reserved. Powered by Intelligent Fund Management, LLC

*PAST PERFORMANCE IS NOT A GUARANTEE OR A RELIABLE INDICATOR OF FUTURE RESULTS. Please note that some of the results we show may be some of our top performing accounts and the results we show are not typical.

**IFM LLC and Nirvana Systems Inc is not a registered investment advisor., and charge a percent of assets under management. However, we do charge for server usage in sending orders to the broker, which costs $49 per month and up, depending on activity. However, we do charge for server usage in sending orders to the broker, which costs $49 per month and up, depending on activity.

© 2024 All Rights Reserved. Intelligent Management Fund, LLC, Nirvana Systems, LLC